OC Home Buyers: How to Find the Perfect Property Without Regrets

OC Home Buyers: How to Find the Perfect Property Without Regrets

Blog Article

Typical Errors to Stay Clear Of for First-Time Home Buyers on Their Trip

As a first-time home buyer, it's easy to ignore crucial aspects of the process. You might believe you prepare, but without a sensible budget and a clear understanding of extra expenses, you can be establishing yourself up for obstacles. Missing essential steps like home mortgage pre-approval or home assessments can bring about costly shocks. Allow's discover these typical errors and exactly how to browse your trip successfully.

Stopping working to Create a Realistic Budget

Creating a solid budget plan is necessary for novice home customers. Include mortgage repayments, home tax obligations, insurance coverage, and maintenance prices in your estimations.

Avoid the lure to extend your spending plan for a dream home; it can lead to financial strain later on. A well-planned budget plan will certainly not only direct your home search however additionally provide peace of mind as you browse this significant financial investment.

Overlooking Added Costs Past the Purchase Cost

Real Estate Tax and Insurance

While you have actually most likely budgeted for the acquisition rate of your new home, it's vital not to ignore the recurring prices of property tax obligations and insurance coverage. Home tax obligations vary based on location and home value, so study your area's rates to stay clear of surprises. By understanding these ongoing expenses, you'll be better prepared to manage your financial resources and appreciate your brand-new home without unexpected monetary stress.

Upkeep and Repair Work Expenses

Lots of new home customers underestimate the relevance of budgeting for upkeep and fixing expenses, which can promptly include up after relocating in. Professionals suggest establishing aside 1% to 3% of your home's worth annually for upkeep. Do not let these expenses capture you off guard-- factor them right into your budget to guarantee a smoother change into homeownership.

Avoiding the Mortgage Pre-Approval Refine

Usually, new home customers forget the relevance of obtaining pre-approved for a home mortgage prior to starting their home search. This step isn't simply a procedure; it's important for specifying your spending plan and improving your search. Without pre-approval, you risk dropping in love with a home you can't pay for, losing time and power.

Pre-approval provides you a clear idea of just how much you can borrow, making you an extra eye-catching buyer. Sellers typically prefer deals from pre-approved customers because it reveals you're serious and financially all set.

Additionally, skipping this step can cause hold-ups later on. When you discover a home you enjoy, you'll want to act swiftly, and having your finances ironed out ahead of time can make all the distinction. Do not take too lightly the power of pre-approval; it sets a strong structure for your home-buying journey.

Forgeting the Importance of a Home Evaluation

When you're buying a home, missing the evaluation can be a pricey error. A detailed examination exposes potential concerns and aids you recognize the property's real condition. Do not overlook this important action; it could save you from unanticipated repair work down the line.

Understanding Inspection Conveniences

While it might be alluring to miss a home examination to conserve time or cash, doing so can lead to expensive surprises down the road. You'll gain understanding right into the home's condition, including the roofing system, plumbing, and electric systems. Bear in mind, a little in advance cost for an evaluation can save you from substantial costs in the future. OC Home Buyers.

Typical Inspection Oversights

Many first-time home customers undervalue visit here the importance of more info here a home inspection, assuming it's either unnecessary or as well pricey. Skipping this important action can result in major oversights. You might miss out on covert concerns like mold, pipes troubles, or electrical hazards that might set you back thousands to repair later on. Don't simply focus on the apparent; evaluate the roofing, foundation, and devices too. Bear in mind to attend the evaluation yourself. By doing this, you'll comprehend any worries direct and ask questions right away. Relying on the seller's disclosures alone can be high-risk. Prioritize your evaluation to shield your investment and warranty assurance. A tiny upfront expense can conserve you from major migraines in the future. Do not ignore this vital process!

Not Investigating the Community

Speak to possible neighbors to get a feel for the neighborhood. Are they pleasant? Do they take treatment of their buildings? This insight can help you comprehend what living there may be like. Don't forget to examine criminal activity rates and future advancement plans. These components can considerably affect your home's value and your quality of life. By investing time in community research, you'll make an extra enlightened choice, guaranteeing your brand-new home is really a place you'll like for years to find.

Hurrying Into a Choice

Rushing into a choice can bring about pricey errors when getting your first home. You might really feel pressured by excitement or an open market, yet taking your time is essential. Avoiding necessary steps like extensive inspections or adequate study can lead to regret and economic stress down the line.

Before making a deal, think about all the elements-- area, budget click for more plan, and future needs. It is necessary to examine buildings very carefully and not just resolve for the very first one that captures your eye. Discuss your alternatives with a trusted real estate agent that can supply useful insights.

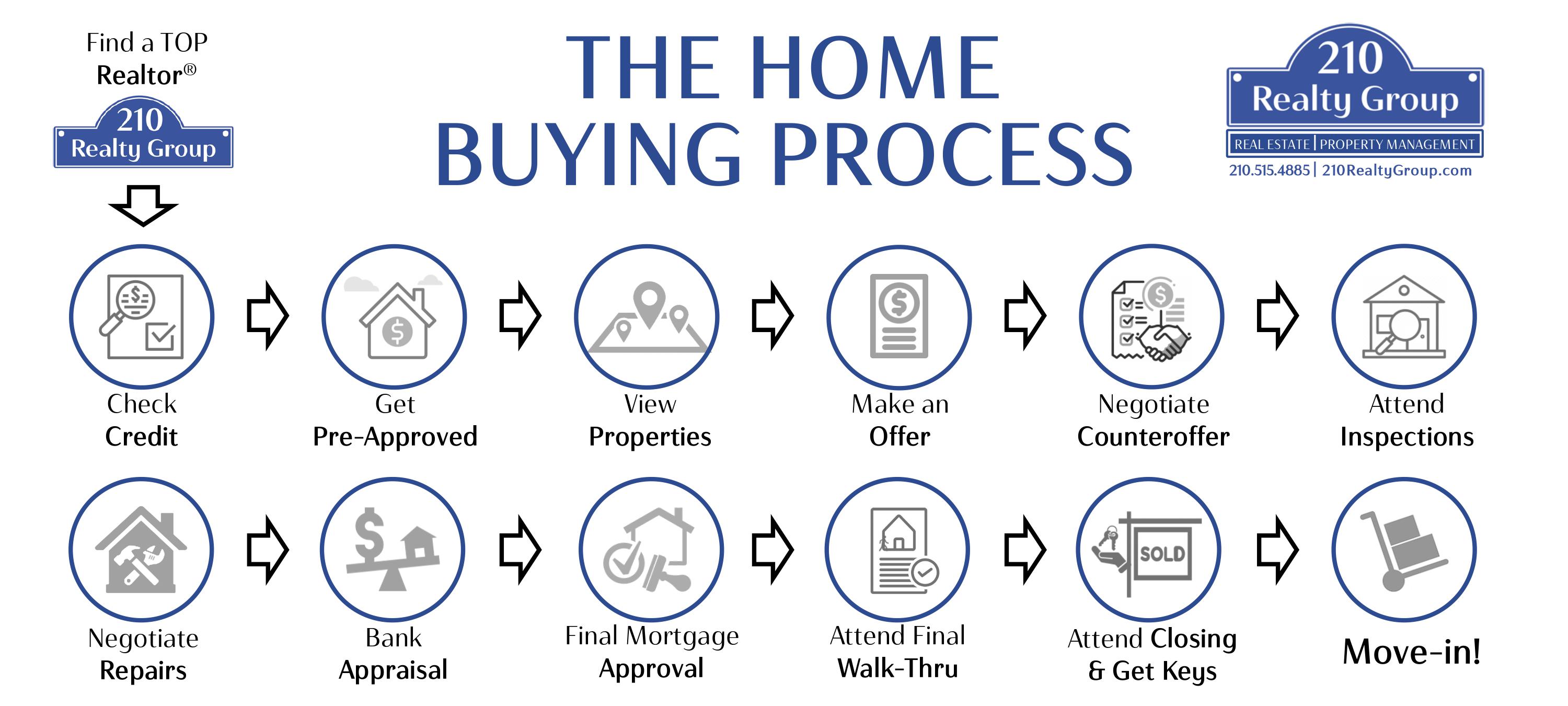

Overlooking to Comprehend the Home Buying Refine

If you don't totally comprehend the home acquiring process, you run the risk of making pricey mistakes. Each step, from browsing for a home to making a deal, plays an essential function in your journey.

Additionally, understand your financial restrictions and just how home mortgage rates function. A clear grasp of these principles helps you make educated choices. By taking the time to enlighten yourself on the home acquiring process, you'll really feel a lot more confident and prepared, inevitably causing a smoother purchase.

Often Asked Inquiries

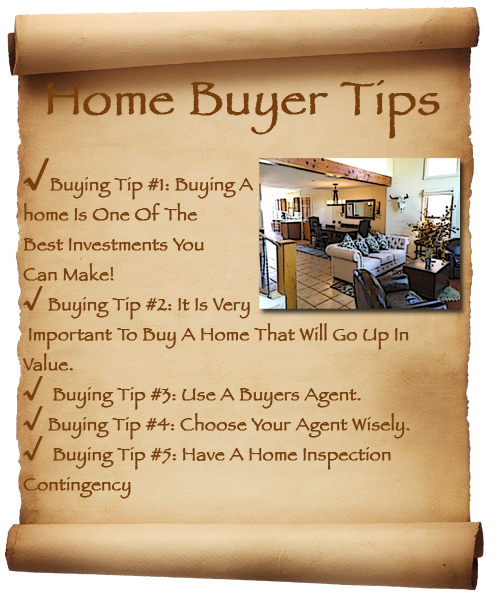

Exactly How Can I Boost My Credit Report Before Buying a Home?

To enhance your credit score before buying a home, pay for existing financial debts, make payments on time, limit brand-new credit scores queries, and examine your credit history record for errors. These steps can noticeably boost your rating.

What Kinds of Mortgages Are Offered for First-Time Customers?

As a first-time buyer, you'll discover a number of mortgage kinds available, like fixed-rate, adjustable-rate, FHA, and VA financings. Each option has distinct benefits, so examine your financial circumstance to select the most effective suitable for you.

Should I Collaborate with a Property Representative or Do It Myself?

You must most definitely consider collaborating with a property agent. They've got the experience and resources to navigate the market, work out much better offers, and save you time, making the home-buying process smoother and much more reliable.

How much time Does the Home Acquiring Refine Commonly Take?

The home acquiring procedure typically takes around 30 to 60 days once you've made an offer. Factors like funding and examinations can expand this timeline, so it's finest to stay prepared and adaptable.

What Are Closing Prices, and Exactly How Much Should I Expect to Pay?

Closing costs are fees due at the home acquisition's end, consisting of financing source, evaluation, and title insurance. You should expect to pay concerning 2% to 5% of the home's cost in closing prices.

Report this page